stamp duty exemption for islamic financing 2018

As mentioned earlier the bnm sac was established under the cba as the authority for the ascertainment of islamic law for the purposes of islamic financial business. Stamp duty on any instruments of an Asset Lease Agreement executed between a customer and a financier made under the Syariah principles for rescheduling or restructuring any.

These include stamp duty exemptions that have been valid since many.

. Stamp Duty Exemption No7 Order 2013. The Stamp Duty Exemption No. In the 2016-17 Budget the government announced further changes to the tax laws to give asset-backed financing arrangements tax treatment consistent with conventional financing.

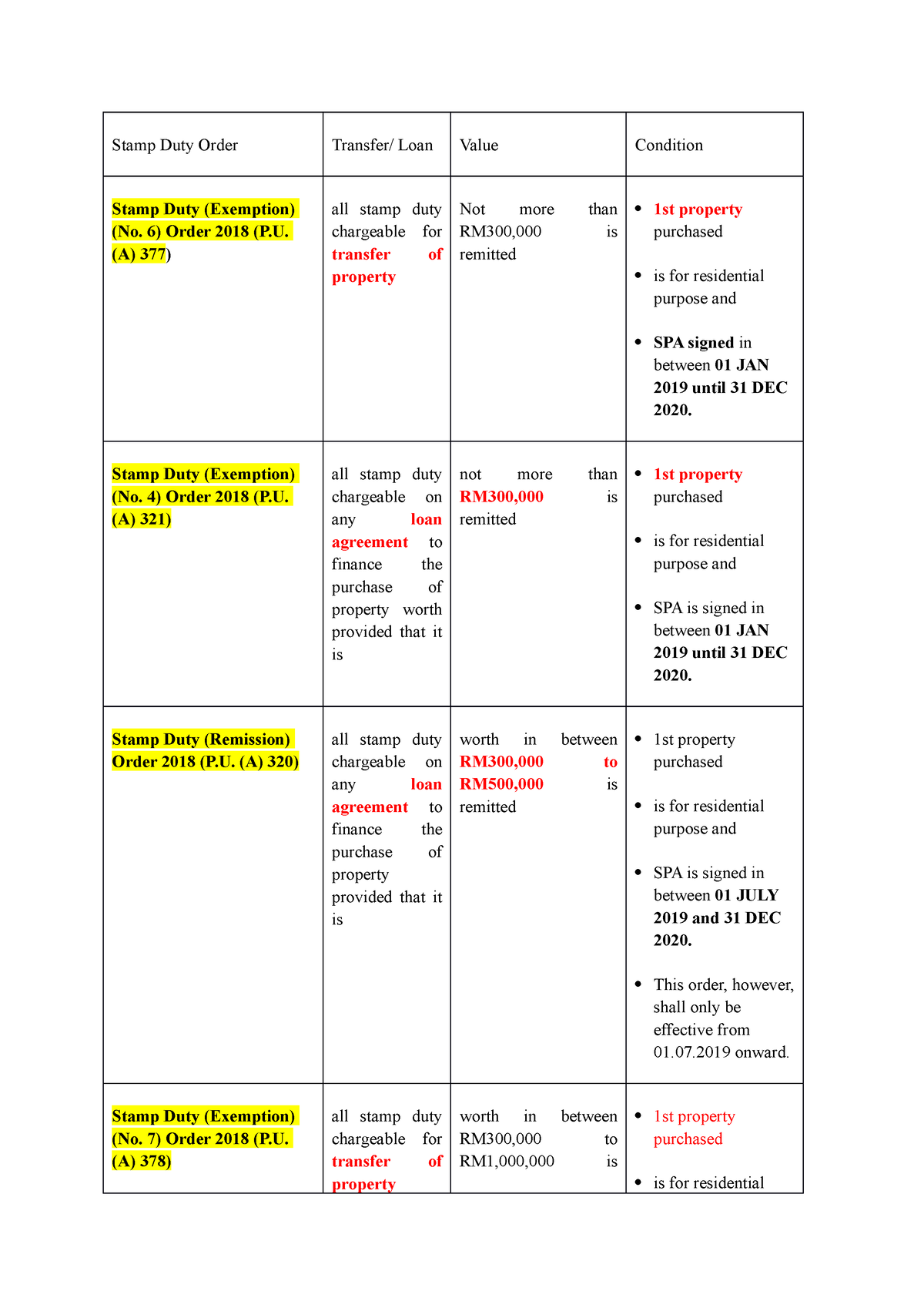

Order Effective date Exemption provided Stamp Duty Exemption No2 Order 2018 1 January 2019 Stamp duty exemption. 3 Order 2004 All instruments made by any financier which relate to purchase of property for the purpose of lease back under the. For the exemption provided for in that paragraph and it can be demonstrated that the services rendered by the members of the Sharia Board are an integral part of that overall management.

RM1000 stamp duty owed on the first. Details of the stamp duty exemption orders are as follows. However moving it to an Islamic bank the existing stamp duty for RM300000 will be totally waived and only the additional top-up amount of RM400000 will incur the normal.

Non- Resident Experts in Islamic finance. Notwithstanding the above it was proposed under the National Economic Recovery Plan 2020 that a stamp duty exemption will be given for MA of SMEs approved by the. Tax exemption on any profits paid out by Islamic banks to non-resident companiesinstitutions for deposits placed at the banks.

Stamp Duty Exemption No7 Order 2018 This Order exempts from stamp duty any instrument of transfer executed in relation to the purchase of one unit of residential property having a. Stamp duty costs represent a significant impediment for Islamic financing structures and without relief being implemented by the States and Territories Islamic finance involving. Non-Resident Experts in Islamic finance.

Stamp Duty Exemption No. 5 Order 2018 was gazetted on 31 December 2018 to provide a stamp duty exemption on any insurance policies or takaful certificates for. The liability to pay Stamp Duty Land Tax or Land Transaction Tax is structured to mirror a conventional mortgage financed purchase so the appropriate tax will be payable on the first.

Income tax exemption is granted for income received by. 2 Order 2020 Exemption Order was gazetted on 21 May 2020 and came into operation retrospectively on 1 March 2020. Pioneer status PS and investment tax allowance ITA The PS incentive involves a tax exemption for 70.

This feature is available in Malaysia where the government agrees to allow for a 100 stamp duty waiver for Islamic Financing when it is refinanced from a conventional. Full tax exemption on income earned from Islamic banking business or takaful business conducted through the International Currency Business Unit in foreign currencies by. So what will the stamp duty be.

The Stamp Duty Exemption No. Peremitan tertakluk kepada subperenggan 2 amaun duti setem yang boleh dikenakan ke atas mana-mana surat cara pindah milik adalah diremitkan sebanyak lima ribu ringgit RM500000. With the start of 2021 here are eleven 11 stamp duty exemption orders that have expired in year 2020.

Where specified conditions are met sections 47E 47F and 47G of the Ordinance provide stamp duty relief on the transfer of bonds and certain instruments not otherwise. Stamp duty would be charged according to 1 on RM100000 of value and 2 on RM400000 of value. Stamp duty costs represent a significant impediment for Islamic financing structures and without relief being implemented by the States and Territories Islamic finance involving.

The Order provides a stamp duty exemption for the instrument of investment notes or Islamic investment notes for P2P financing executed by MSMEs or between MSMEs and. Assessment YA 2018 to 2020 fully claimable within two years of assessment. 20 stamp duty remission on Islamic.

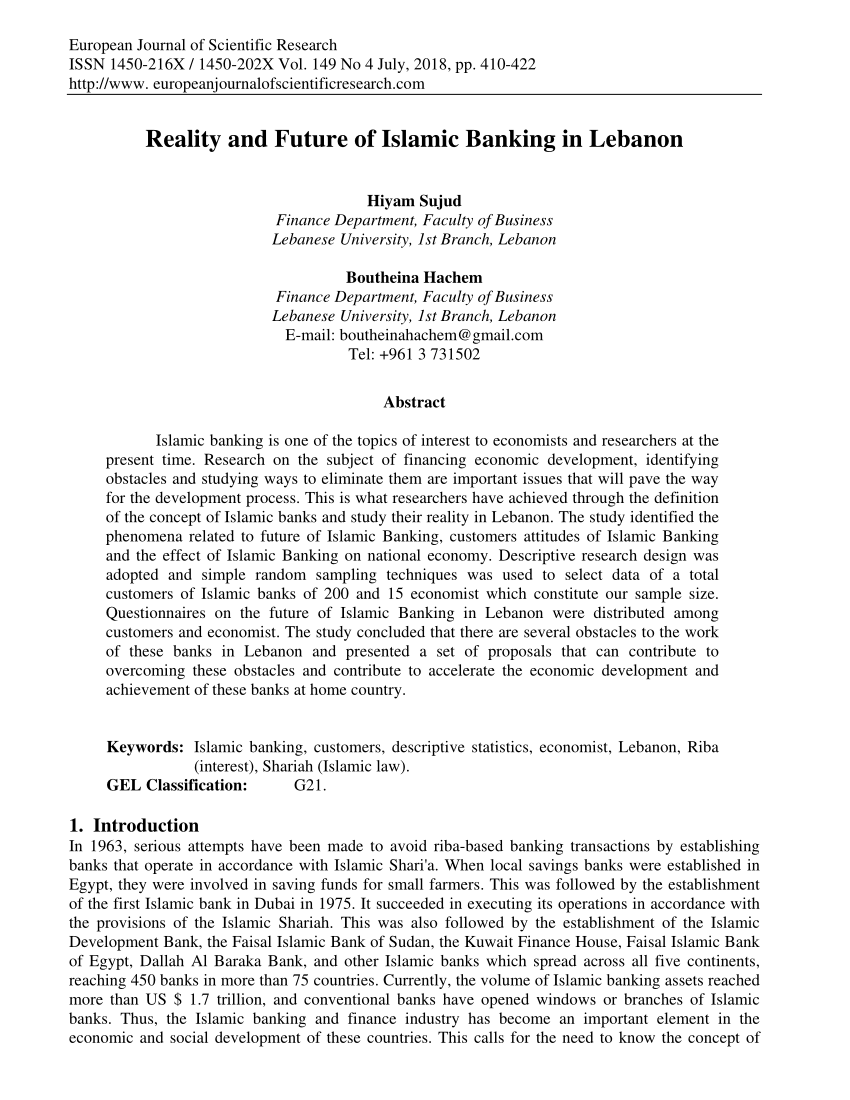

Pdf Reality And Future Of Islamic Banking In Lebanon

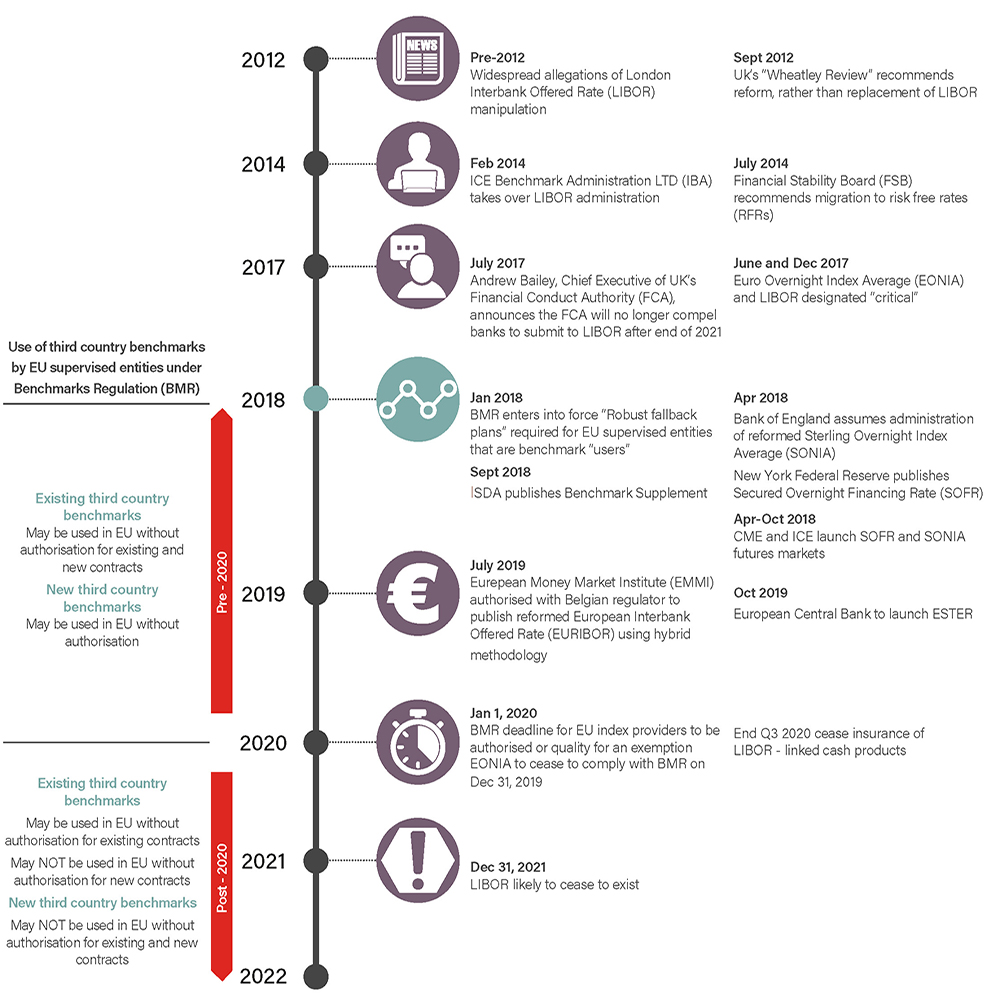

Benchmark Reform The Impact Of Ibor Transition On The Islamic Banking Industry Uganda Global Law Firm Norton Rose Fulbright

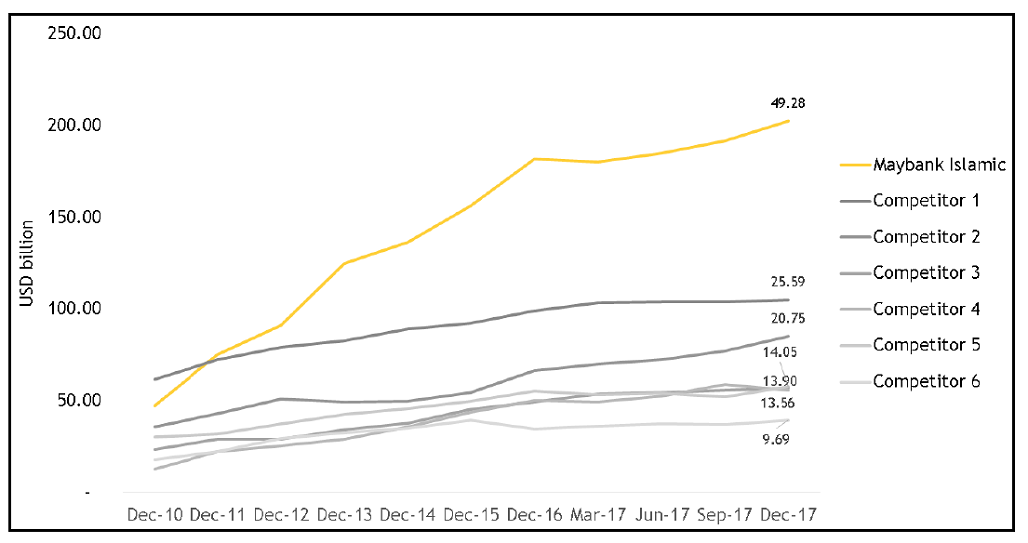

Aba Position Paper On Maybank S Experience In Islamic Banking Asian Bankers Association

Denmark Taxing Wages 2021 Oecd Ilibrary

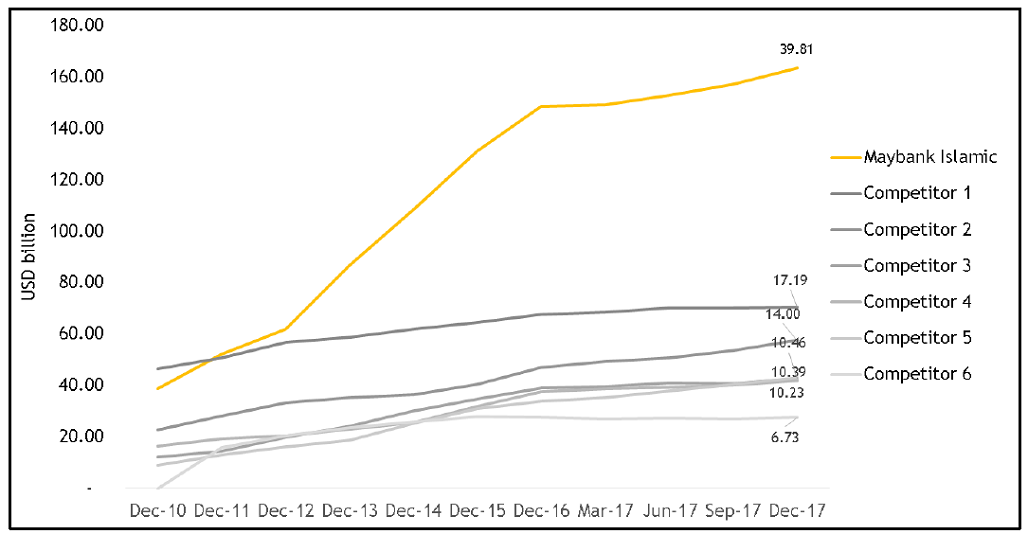

Aba Position Paper On Maybank S Experience In Islamic Banking Asian Bankers Association

Insight Sharia Instruments Of Financing Tax Implications Part 2

Guide To Islamic Home Financing In Malaysia Propsocial

Insight Sharia Instruments Of Financing Tax Implications Part 2

Stamp Duty Orders Table Form Stamp Duty Order Transfer Loan Value Condition Stamp Duty Studocu

Guide To Islamic Home Financing In Malaysia Propsocial

Making Islamic Banking First Choice For Pakistanis

Islamic Finance And Participatory Financing Constraints In Pakistan Springerlink

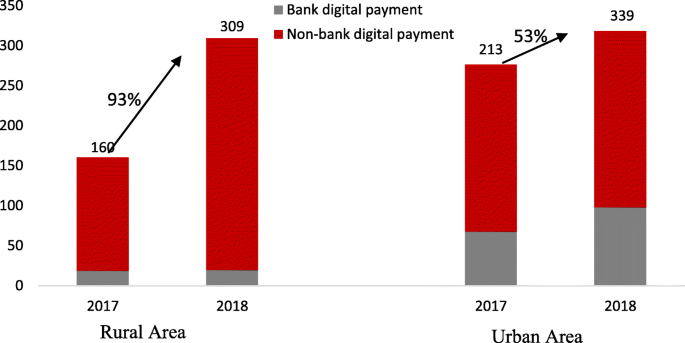

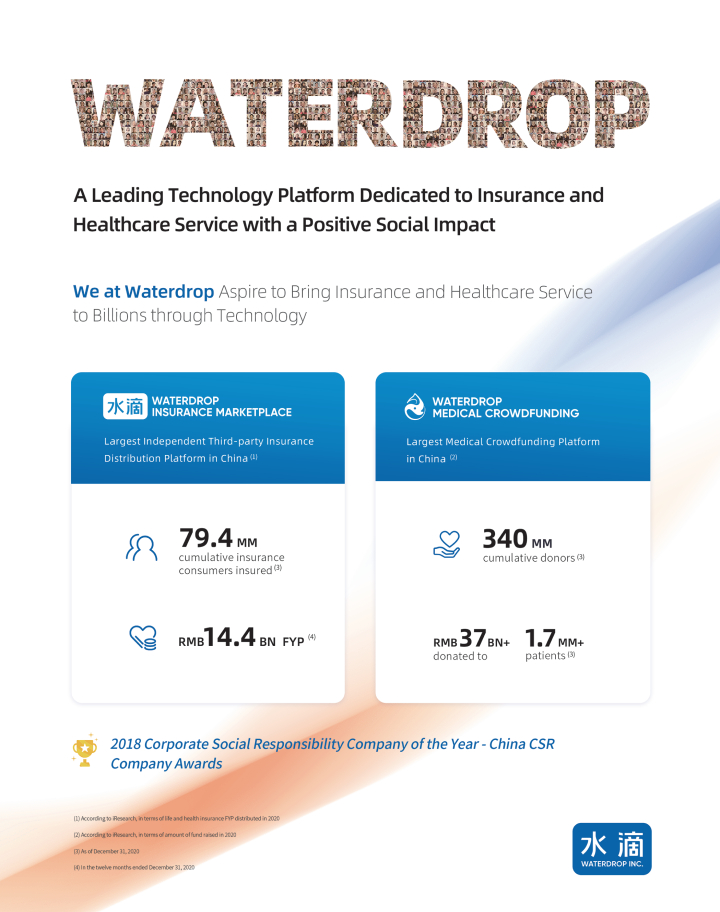

Financial Inclusion In China An Overview Frontiers Of Business Research In China Full Text

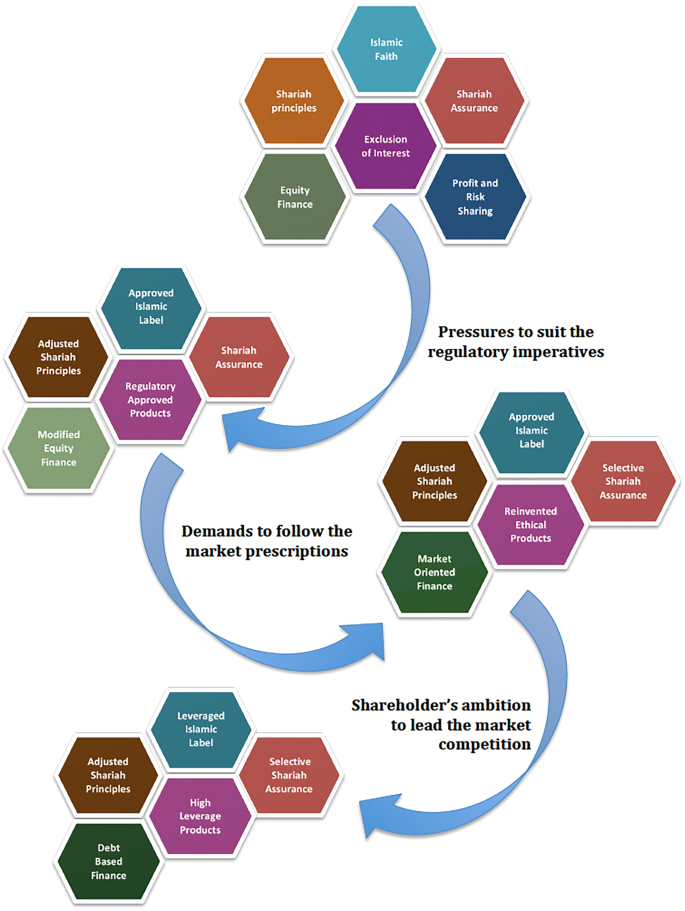

Identity Drift The Multivocality Of Ethical Identity In Islamic Financial Institution Springerlink

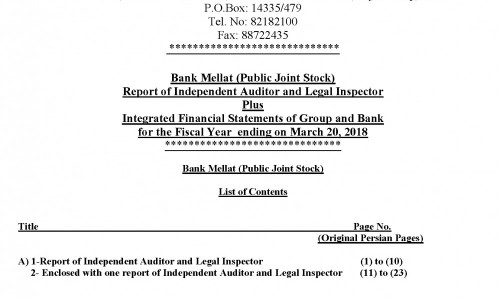

Bank Mellat Integrated Financial Statements March 2018 Islamicmarkets Com

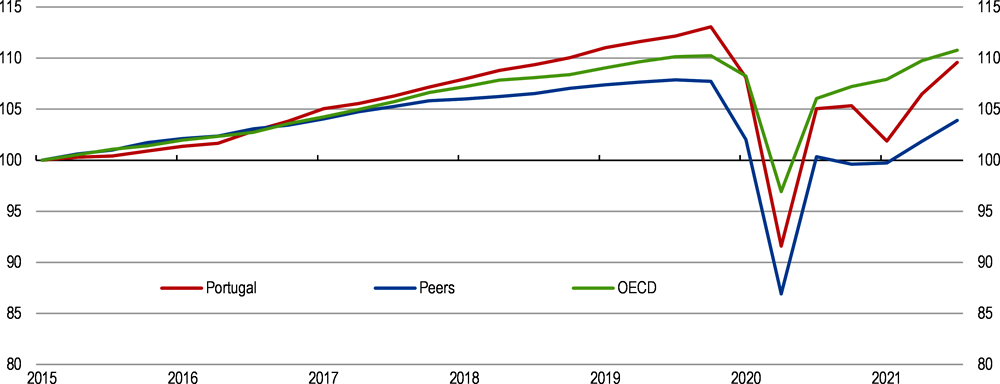

1 Key Policy Insights Oecd Economic Surveys Portugal 2021 Oecd Ilibrary

Pdf Document 1 1 Legislative Intervention In Support Of Islamic Banking In Malaysia

/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)

Comments

Post a Comment